Let’s be honest. Real estate investing has always been a game of information. The person with the best data, the sharpest insights, and the quickest ability to act usually wins. For decades, that meant local knowledge, a fat Rolodex, and frankly, a fair bit of gut feeling.

But the game has changed. Dramatically. Today, the most powerful tool in an investor’s arsenal isn’t just a trusted contractor—it’s technology. We’re talking about proptech: the collision of property and technology that’s reshaping everything from how we find a deal to how we manage it.

Here’s the deal: leveraging proptech isn’t about replacing the human element. It’s about augmenting it. Supercharging your decision-making with tools that cut through the noise and highlight genuine opportunity. Let’s dive into how.

Beyond the Spreadsheet: Data & Analytics Take Center Stage

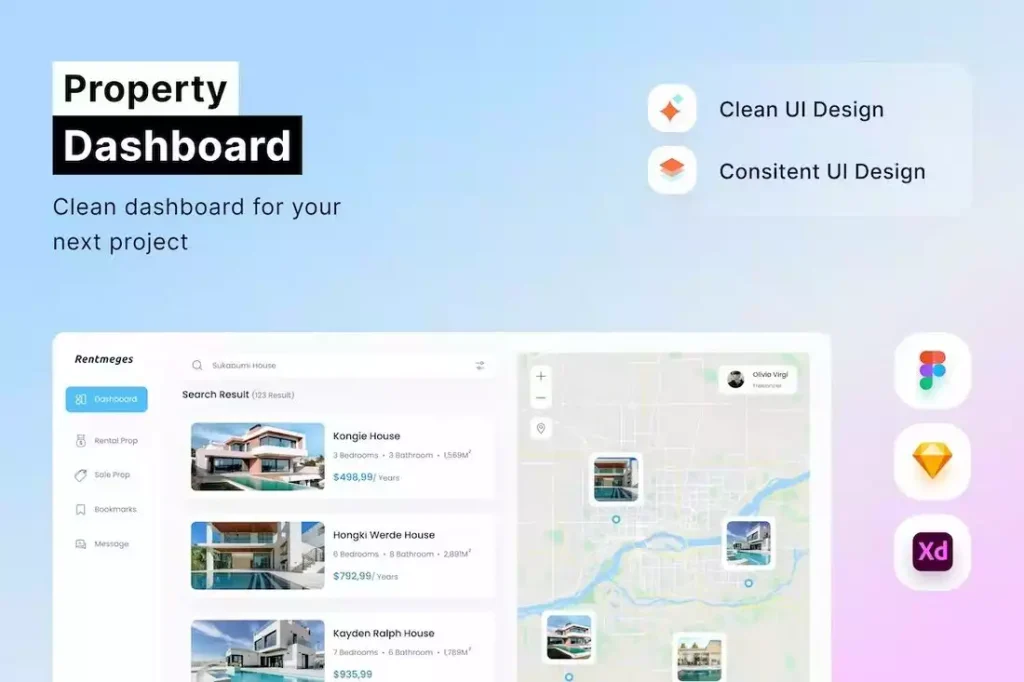

Gone are the days of manually comping properties on a notepad. Modern proptech platforms aggregate and analyze staggering amounts of data—think of it as having a research assistant who never sleeps.

These tools can show you not just what a property sold for, but its rental yield history, neighborhood demographic shifts, future development pipelines, and even local sentiment from social media. This level of predictive analytics for real estate helps you answer the crucial question: “Where is this market headed?”

For instance, you might spot a neighborhood where new business permits are skyrocketing but rents haven’t yet caught up. That’s a signal. Or you could avoid an area where satellite data shows increasing flood risk, a factor traditional data might miss. This is about making smarter real estate investments with a foundation of hard numbers, not just hunches.

Key Tools in the Data Arsenal

- Automated Valuation Models (AVMs): Instant, algorithm-driven estimates that provide a solid starting point.

- Investment Analysis Software: Platforms that crunch cash flow, cap rates, and ROI scenarios in seconds under different conditions.

- Geospatial & Foot Traffic Data: Overlaying property maps with where people actually work, shop, and spend time. It’s like X-ray vision for commercial potential.

The Viewing Revolution: Virtual, Augmented, and Just Plain Easier

Remember driving across town for a 10-minute walkthrough of a property that was clearly wrong? That pain point is evaporating. Virtual tours and 3D walkthroughs are now table stakes. They let you screen dozens of properties from your laptop, saving immense time.

But it goes further. Augmented Reality (AR) is creeping in. Imagine pointing your phone at a vacant lot and seeing a proposed building rendered in real space. Or using a VR headset to visualize a renovation before swinging a single hammer. This tech isn’t just a gimmick; it reduces risk and improves planning accuracy dramatically.

And for managing remote investments? Digital twins—virtual replicas of physical assets—allow you to monitor systems, plan maintenance, and even show units to prospective tenants without being on-site. It’s a game-changer for long-distance real estate investing.

Streamlining the Grind: Automation in Operations & Management

Acquisition is one thing. The real grind, you know, is often in the management. Proptech shines here by automating the tedious.

| Pain Point | Proptech Solution | Impact |

| Tenant Screening & Leasing | Online platforms with integrated background/credit checks, digital signing. | Faster turnover, reduced risk, paperless process. |

| Rent Collection & Accounting | Automated payment portals synced with accounting software. | Improved cash flow, fewer late payments, cleaner books. |

| Maintenance Requests | Tenant apps to log issues, automatically routed to pre-vetted contractors. | Faster resolutions, happier tenants, tracked repair histories. |

| Communication | Centralized portals for announcements, documents, and messages. | Less “noise” in your personal inbox, professionalized interaction. |

This automation does two powerful things. First, it frees you up to focus on strategy and growth, not chasing rent checks. Second, it creates a better experience for tenants, which directly translates to higher retention rates and lower vacancy costs—a direct boost to your bottom line.

The Blockchain Frontier: Transparency & New Models

This one can sound futuristic, but its applications are becoming real. Blockchain, the technology behind cryptocurrencies, offers a secure, transparent ledger. In real estate, that means potential for fractional property ownership through tokenization.

Imagine owning a share of a prime commercial building with the liquidity of a stock. It democratizes access to high-value assets. Furthermore, smart contracts—self-executing contracts on the blockchain—could automate things like distributing rental income to fractional owners or triggering fees upon lease signing, reducing administrative overhead and friction.

Getting Started Without Getting Overwhelmed

Okay, so the landscape is vast. The key is to start small and be strategic. Don’t try to boil the ocean.

- Identify Your Biggest Friction Point. Is it finding deals? Analyzing them quickly? Managing tenants? Start by solving for that one pain.

- Embrace a “Pilot” Mindset. Test one new tool on a single property or deal. See how it integrates with your current workflow before rolling it out everywhere.

- Focus on Integration. The best tools talk to each other. Look for platforms that connect your CRM, your accounting software, and your listing sites to avoid data silos.

- Never Outsource Your Judgment. Tech provides insights, not answers. The final call—the intuition about a neighborhood’s vibe, the quality of a building’s bones—that still rests with you.

The Human Element in a Digital Age

In the end, proptech is just that—a tool. A phenomenally powerful one, sure. But the essence of real estate remains deeply human. It’s about providing homes, creating spaces for business, and building community assets.

The most successful investors of this new era will be those who can pair the cold, clear logic of data with warm, human insight. Who use a drone to survey a roof but still knock on a neighbor’s door to ask about the street. The technology handles the ‘what’ and the ‘how many.’ It’s still up to you to understand the ‘why.’

So, the landscape isn’t just changing; it’s offering a new language of opportunity. The question isn’t really whether to adopt these innovations, but how quickly you can learn to speak it.